Harmonic Pattern Trading Course in Delhi

Frequently Asked Questions about Harmonic Pattern Trading Course

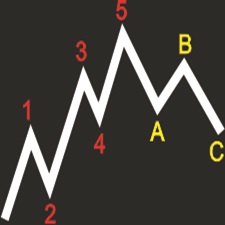

1. What are harmonic patterns in trading?

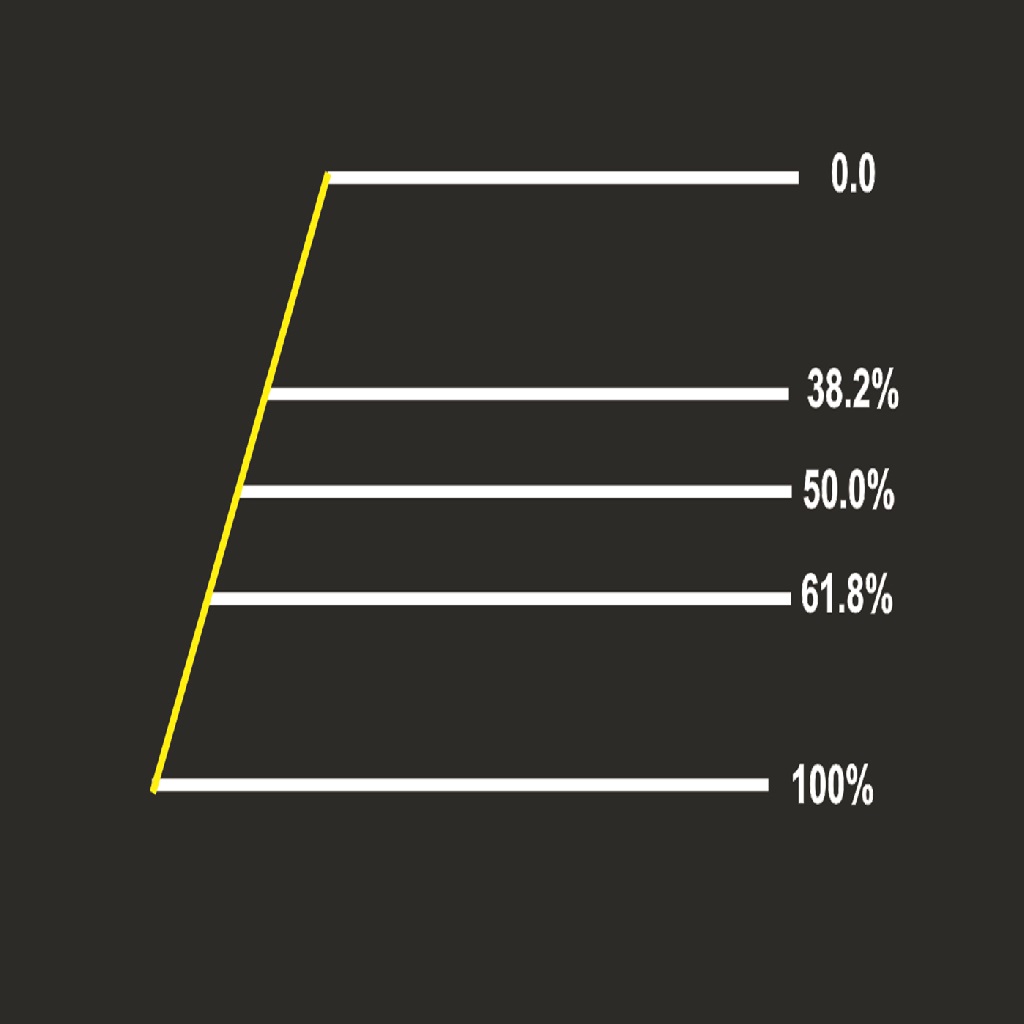

Harmonic patterns are price patterns used in technical analysis that indicate potential market reversals based on Fibonacci ratios.

These Patterns makes some shapes of creatures like Butterfly, Bats, Shark, Crab etc. Harmonic patterns are very useful for every trader.

2. Who can Join this Harmonic Trading course?

This course is suitable for beginner to intermediate traders who want to understand advanced technical analysis, specifically harmonic patterns.

3. What topics are covered in the course? The course covers the basics of Fibonacci ratios,

key harmonic patterns like Gartley, Butterfly, Bat, and Crab, how to identify these patterns, and practical trading strategies.

4. What is the duration of Harmonic Trading course?

The course typically 3-4 weeks, with 2 hours session / per day.

5. Do I need prior knowledge of technical analysis?

Basic knowledge of technical analysis and chart reading is recommended but not mandatory.

The course usually starts with a brief introduction to key concepts.

6. Is the course conducted online or in-person?

we offer both online and in-person classes in Delhi at our Lajpat Nagar and Laxmi Nagar Branch,

allowing students to choose the most convenient option.

7. What kind of support will I receive after the course?

Many courses offer post-training support like webinars, Q&A sessions, and access to private trading communities.

8. Will I get any practical trading experience during the course?

Yes, this courses is designed to teach these Harmonic patterns in live trading sessions to help students apply what they've learned during the session.

9. What is the cost of Harmonic Pattern Trading course?

We are charging very nominal fees for this course that is ₹9,999 only.

10. Do I receive a certificate after completing the course?

Yes, after completing the course, we will provide a certificate of completion, which can be helpful for your professional development in trading.