5 Types of DOJI Candles

5 Types of Doji candlesticks: Today, we are going to learn about 5 Types of Doji candlesticks, A Doji candle is a neutral candlestick pattern that signifies indecision in the market. It forms when the open and close prices are almost the same, resulting in a very small or non-existent body, with shadows of varying lengths extending from the body. The pattern reflects a tug-of-war between buyers and sellers, where neither side gains significant control by the close of the trading session.

There are 5 Types of Doji candlesticks, each with different implications depending on its context within a trend:

- Standard Doji: The open and close prices are the same, with upper and lower shadows of roughly equal length. It suggests market indecision.

- Gravestone Doji: The open, low, and close prices are at or near the same level, with a long upper shadow. It is typically seen as a bearish reversal signal after an uptrend.

- Dragonfly Doji: The open, high, and close prices are at or near the same level, with a long lower shadow. It often indicates a bullish reversal after a downtrend.

- Long-Legged Doji: The open and close prices are the same, but with long upper and lower shadows, reflecting significant indecision and market volatility.

- Four Price Doji: A rare pattern where the open, high, low, and close are all the same, indicating complete market indecision.

In summary, a Doji candle reflects a balance between buyers and sellers, with the market lacking a clear direction. Its significance often depends on the prevailing trend and the type of Doji that forms.

1. Standard Doji :

The Standard Doji is a basic

The Standard Doji is a basic

- body of a Standard Doji is minimal or non-existent, as the opening and closing prices are very close or the same.

candlestick pattern that highlights market indecision. It forms when the opening and closing prices are almost identical, resulting in a candlestick with a very small body and shadows (upper and lower) of varying lengths.

Key Characteristics:

- Body: The Shadows: The upper and lower shadows can be of varying lengths, reflecting the price range during the trading session.

- Formation: It can appear aft

- er any trend (uptrend or downtrend) or during consolidation periods.

Implications:

- Indecision: The Standard Doji indicates a battle between buyers and sellers, with neither side gaining a clear advantage. This indecision can lead to a potential reversal o

r continuation of the current trend, depending on subsequent price action. - Context: The significance of a Standard Doji is often enhanced when it appears at key levels of support or resistance or after a strong trend.

Confirmation:

- Traders typically look for confirmation from the next candle(s) to determine the market’s direction. For example, a bullish candle following a Standard Doji after a downtrend might signal a bullish reversal, while a bearish candle after an uptrend might indicate a bearish reversal.

In summary, the Standard Doji reflects uncertainty and equilibrium in the market, and its meaning is often clarified by subsequent price action.

2. Four Price Doji

The Four Price Doji is a rare and unique candlestick pattern where the open, high, low, and close prices are all the same. This pattern appears as a single horizontal line without any shadows, indicating a complete lack of market movement and extreme indecision.

Key points about the Four Price Doji:

- Formation: Four Price Doji typically occurs in markets with very low volume or during times of indecision.

- Implication: The pattern suggests that neither buyers nor sellers are in control, leading to a complete stalemate. This lack of movement usually indicates that the current trend might continue, but because of its rarity, it’s not always a reliable predictor of future market direction.

- Context: The Four Price Doji is often seen during periods of consolidation or in very thinly traded markets.

In summary, the Four Price Doji is a sign of extreme market indecision, with no clear indication of where the market might head next.

3. Long Legged Doji:

The Long-Legged Doji is a candlestick pattern that reflects market indecision. It has long upper and lower shadows, with the open and close prices at or near the same level. The extended shadows show that both buyers and sellers were active, but neither side could gain control, resulting in a standoff by the session’s end.

Key points about the Long-Legged Doji:

- Formation: Long-Legged Doji can appear during uptrends, downtrends, or consolidation phases.

- Implication: The pattern indicates uncertainty in the market, as neither buyers nor sellers dominate. The market could reverse or continue in its current direction, so additional signals or confirmation are often needed.

- Confirmation: Traders typically wait for the next candle to confirm the market’s direction after a Long-Legged Doji.

In summary, the Long-Legged Doji suggests a struggle between buyers and sellers, with no clear winner, signaling potential volatility or a trend change.

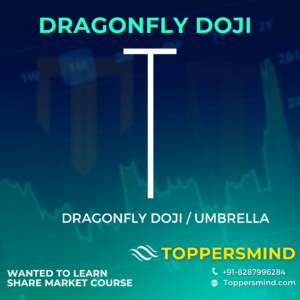

4. Dragon Fly Doji / Umbrella

The Dragonfly Doji also known as Umbrella Candle. Dragonfly Doji is a bullish candlestick pattern that indicates a potential reversal at the bottom of a downtrend. It forms when the open, high, and close prices are all at or near the same level, resulting in a candlestick with a long lower shadow and little to no upper shadow. This pattern shows that sellers drove the price down significantly during the session, but buyers stepped in and pushed the price back up to the opening level by the close.

Key points about the Dragonfly Doji:

- Formation: Dragonfly Doji typically appears after a downtrend.

- Implication: Dragonfly Doji suggests that the downtrend may be losing strength and a bullish reversal could occur.

- Confirmation: Traders often look for a bullish candle after the Dragonfly Doji to confirm the reversal.

In summary, the Dragonfly Doji is a potential signal of a market shift from bearish to bullish.

5. Gravestone Doji / Inverted Umbrella

The Gravestone Doji also known as Inverted Umbrella candle. Gravestone Doji is a bearish candlestick pattern that signals a potential reversal at the top of an uptrend. It occurs when the open, low, and close prices are all at or near the same level, creating a candle with a long upper shadow and little to no lower shadow. The long upper shadow indicates that buyers pushed prices higher during the session, but sellers eventually overpowered them, driving the price back down to the opening level.

Key points about the Gravestone Doji:

- Formation: Gravestone Doji usually appears after a bullish trend.

- Implication: Gravestone Doji suggests that the uptrend might be losing momentum and a bearish reversal could be on the horizon.

- Confirmation: Traders often wait for a bearish candle after the Gravestone Doji for confirmation of the reversal.

In summary, the Gravestone Doji is a warning sign that the market may be shifting from bullish to bearish.

So, There were the 5 Types of Doji candlesticks. If you are looking for Technical Analysis Course Call us Now 8287996284. Follow us on Instragram @MohsinMahfooz