Inverted Head and Shoulders Pattern:

Formation, Trading Strategy, and Accuracy

What is an Inverted Head and Shoulders Pattern?

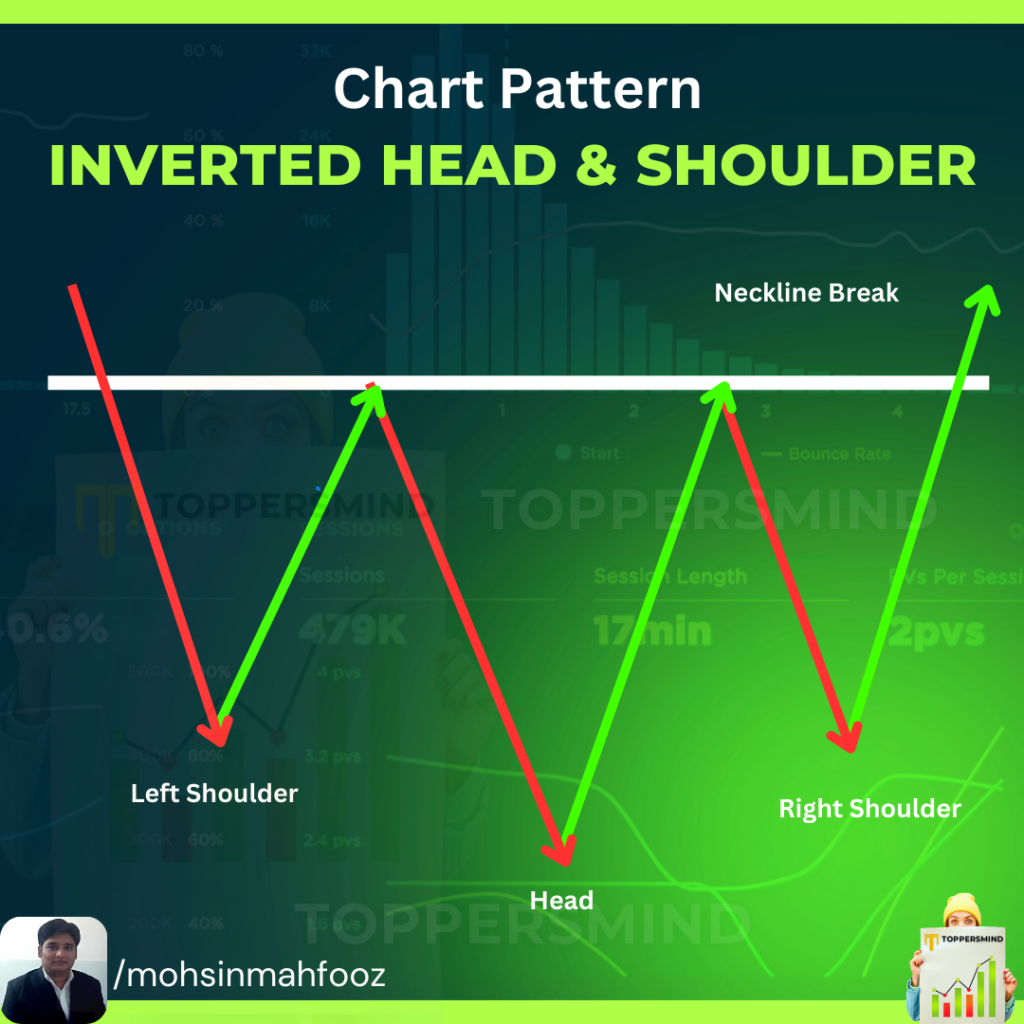

The Inverted Head and Shoulders or inverse head and shoulder is a bullish reversal chart pattern that often signals the end of a downtrend and the beginning of an upward move. It is widely used by traders to identify potential buying opportunities.

Formation of Inverted Head and Shoulders

The pattern consists of three main components:

- Left Shoulder: A price decline followed by a temporary rise.

- Head: A lower low, forming the lowest point of the pattern.

- Right Shoulder: A higher low, indicating a reduction in selling pressure.

- Neckline: A resistance level connecting the highs of the left shoulder and the right shoulder. A breakout above this neckline confirms the pattern.

How to Trade the Inverted Head and Shoulders Pattern

Follow these steps to trade effectively:

- Identify the Pattern: Spot the formation of the left shoulder, head, and right shoulder during a downtrend.

- Draw the Neckline: Connect the peaks of the left shoulder and right shoulder to establish a neckline.

- Wait for Breakout: A confirmed breakout occurs when the price closes above the neckline with strong volume.

- Entry Point: Enter a long position after the breakout, ideally with a retest of the neckline.

- Stop Loss Placement: Place a stop loss below the right shoulder or head, depending on your risk tolerance.

- Target Price: Measure the distance from the head to the neckline and project it upwards from the breakout point to estimate your profit target.

Accuracy and Reliability

The Inverted Head and Shoulders pattern is generally considered reliable with a 60-70% accuracy rate. Higher accuracy is often seen when the breakout is supported by strong trading volume and overall market momentum. However, always use additional technical indicators to confirm the trade.

Final Thoughts

The Inverted Head and Shoulders pattern is a powerful tool for traders seeking to capitalize on trend reversals. While it is not infallible, combining it with proper risk management and supporting indicators can significantly enhance trading success. if you are looking for best institute for learning Technical Analysis course in Delhi call us Now 8287996284