The Bullish Cypher Harmonic Pattern

The Bullish Cypher Harmonic Pattern is a sophisticated tool used by traders to spot potential reversal zones and optimize entry points in the market. Its unique structure makes it highly accurate when identified correctly, leading to profitable trading opportunities. In this post, we’ll dive deep into understanding the pattern, how to identify it, and how traders can leverage it for a bullish reversal setup.

What is the Bullish Cypher Harmonic Pattern?

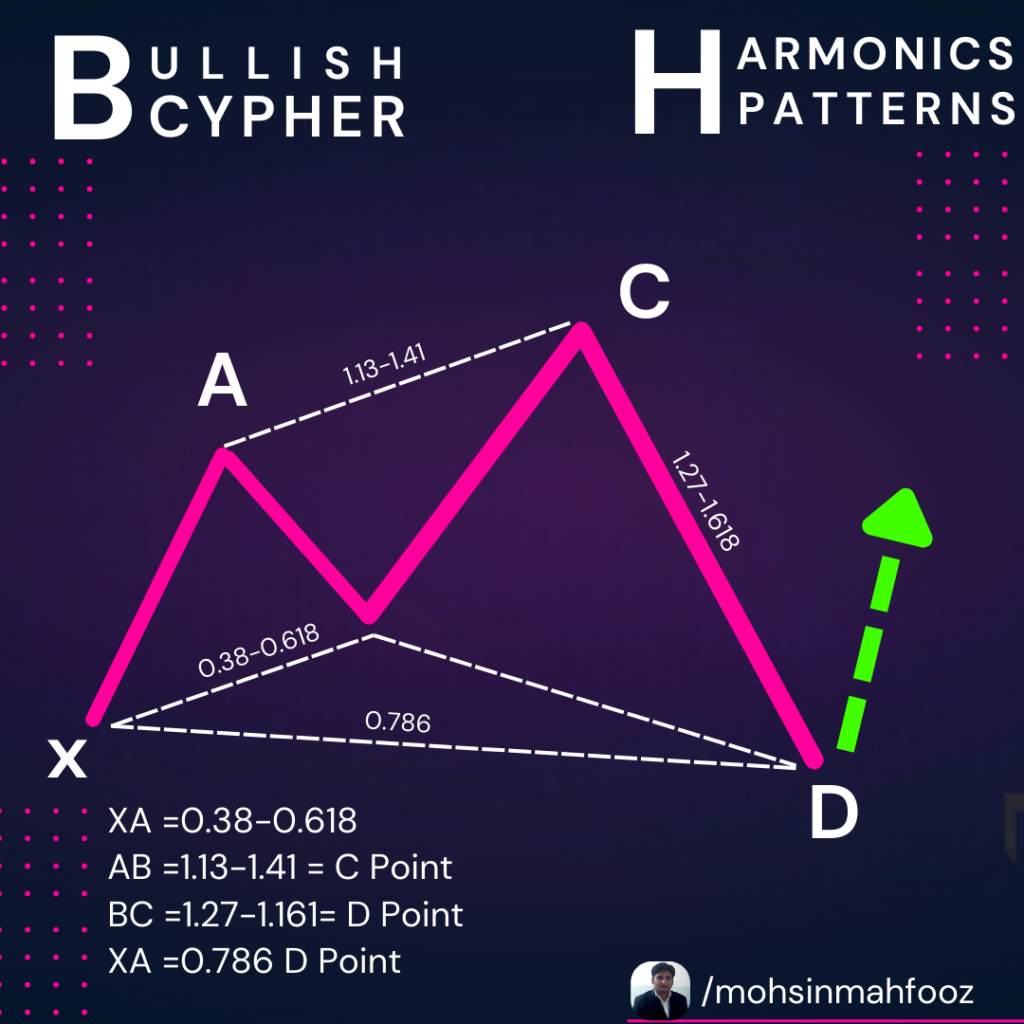

The Bullish Cypher is a complex harmonic pattern that indicates a potential bullish reversal in a downtrend. It consists of four legs marked as X-A, A-B, B-C, and C-D, forming a structure similar to a stretched ‘M’ on a price chart.

Key Features of the Bullish Cypher Pattern

- Leg X-A: The first leg starts with a significant move, usually downward in the case of the bullish cypher, forming the X to A leg.

- Leg A-B: The second leg retraces between 38.2% and 61.8% of the X-A move.

- Leg B-C: The B-C leg is an extension of the A-B move and typically reaches 113% to 141.4% of the A-B leg.

- Leg C-D: The final leg is the critical point of the pattern. The D point should retrace to 78.6% of the X-A leg, offering an ideal zone for entering long positions.

How to Identify the Bullish Cypher Pattern

- Spot the X-A Leg: Look for an initial significant move, typically a downward impulse, which sets the X and A points.

- Check the A-B Retracement: Ensure the A-B leg retraces between 38.2% and 61.8% of the X-A leg.

- Look for the B-C Extension: The B-C leg should extend beyond point B, reaching between 113% and 141.4% of the A-B leg.

- Confirm C-D Completion: The D point should end at approximately 78.6% of the X-A leg.

How to Trade the Bullish Cypher Pattern

- Entry Point: The ideal entry is at the D point, which signifies the completion of the pattern. Look for confirmation signals like candlestick patterns (e.g., bullish engulfing) at this level.

- Stop-Loss Placement: A safe stop-loss is typically placed just below the X-point, ensuring you are protected if the pattern fails.

- Profit Target: Common take-profit levels include the 38.2% and 61.8% Fibonacci retracement of the C-D leg, as price usually retraces back up to these levels.

Why Trade the Bullish Cypher?

The Bullish Cypher pattern is revered for its high probability of success when accurately identified. Unlike some other harmonic patterns, it offers a deeper retracement (at the 78.6% level), providing traders a better risk-to-reward ratio and increasing the odds of a successful trade.

Tips for Mastering the Cypher Pattern

- Patience: The pattern takes time to develop, so avoid rushing into trades. Wait for the completion of the C-D leg before entering.

- Combine with Other Tools: Use Fibonacci levels, support and resistance zones, and candlestick patterns to confirm the trade setup.

- Practice on Demo Accounts: Before trading live, ensure you practice spotting and trading the Cypher on a demo account.

Final Thoughts

The Bullish Cypher Harmonic Pattern is a powerful tool in a trader’s arsenal, offering a reliable method to enter bullish trades during a reversal. However, as with all technical patterns, it’s crucial to combine it with other indicators and trade management strategies for the best results.

With patience and practice, you can master this harmonic pattern and incorporate it into your trading strategy effectively.

If you are looking for Technical Analysis course in Delhi Call us Now 8287996284. Follow us on Instagram @mohsinmahfooz