Bearish Cypher Harmonic Pattern

A Guide for Traders

The Bearish Cypher Harmonic Pattern is one of the advanced harmonic patterns in the world of technical analysis. It is favored by seasoned traders due to its precision and the high-probability trading opportunities it provides. In this blog, we will break down the components of the bearish cypher pattern, how to identify it, and how traders can use it to predict market reversals.

What is a Bearish Cypher Pattern?

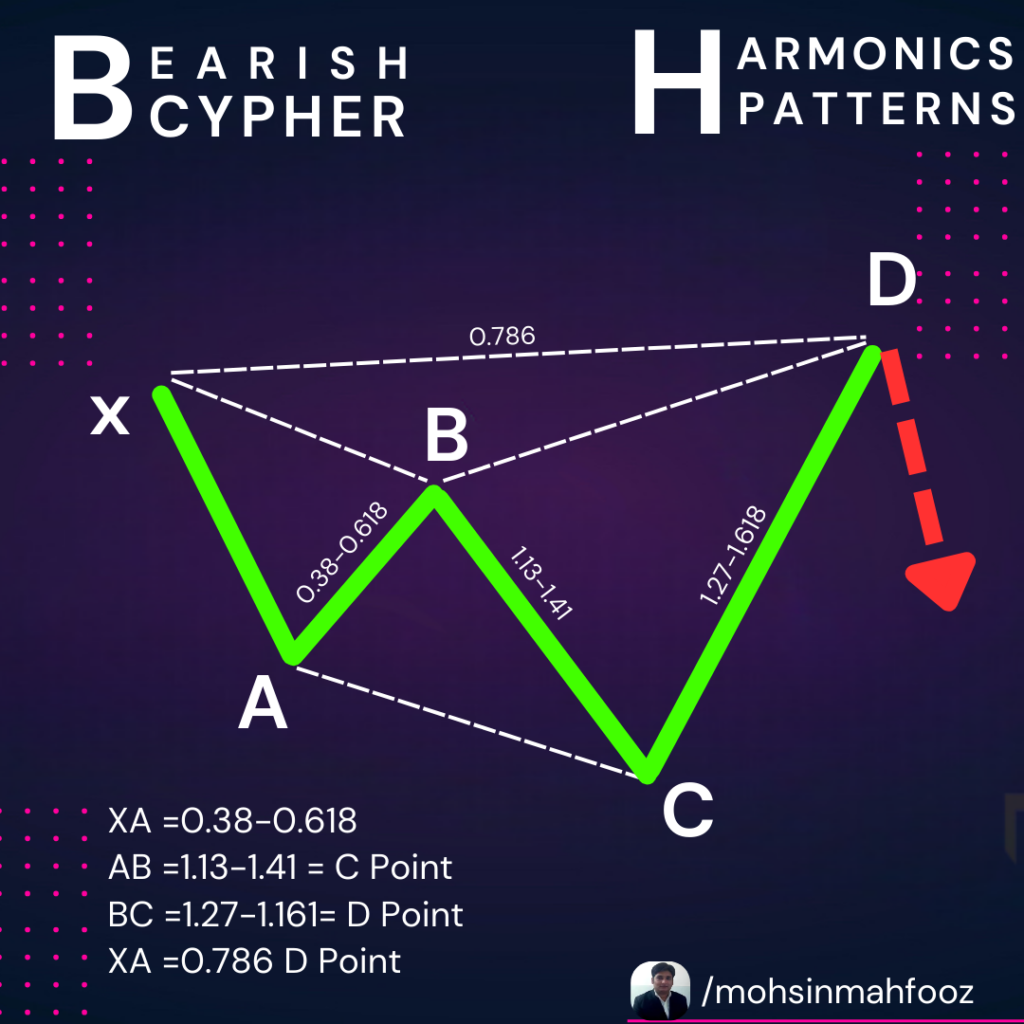

The bearish cypher pattern is a reversal pattern that helps traders spot potential bearish moves in the market. It consists of four key legs, which are labeled as X, A, B, C, and D. The pattern forms when a bullish trend starts to lose momentum and gives traders an opportunity to short the market at the right time, with the goal of profiting from a reversal to the downside.

The cypher pattern stands out due to its unique combination of Fibonacci retracements and extensions, which are used to confirm the pattern’s formation.

Key Components of the Bearish Cypher Pattern

- X-A Leg: The first leg is a bullish impulse move, establishing the pattern’s overall direction.

- A-B Leg: The price retraces from point A to point B. This retracement usually reaches around the 38.2% to 61.8% Fibonacci level of the X-A leg.

- B-C Leg: This leg sees the price rise again, creating another upward move. However, it should not exceed the X point and often retraces to the 113% to 141% Fibonacci extension of the A-B leg.

- C-D Leg: The final leg is a retracement of the B-C leg. Ideally, point D should be located near the 78.6% Fibonacci retracement of the X-C leg. This is where the bearish reversal is expected to take place.

How to Trade the Bearish Cypher Pattern

Trading the bearish cypher pattern involves recognizing the pattern’s completion and entering a short position at point D. Here’s a step-by-step approach:

- Identify the Pattern: Using Fibonacci retracements and extensions, traders should confirm that the price movement follows the precise ratios described above. Ensure the market creates the characteristic X, A, B, C, and D points.

- Wait for Completion at Point D: Point D is the most crucial point of the pattern. Once the price reaches the 78.6% retracement of the X-C leg, this is the optimal entry for a short position.

- Set Your Stop-Loss: Place your stop-loss slightly above point X, as a break above X would invalidate the pattern.

- Target Your Profit Levels: Traders typically set profit targets at the 38.2% or 61.8% Fibonacci retracement of the C-D leg. These levels provide a good risk-reward ratio and help manage potential losses.

Why Trade the Bearish Cypher?

The bearish cypher harmonic pattern stands out for its high accuracy when combined with other forms of technical analysis, such as trendlines or support and resistance levels. Traders favor this pattern because:

- High Probability: The cypher pattern is known for providing reliable signals, giving traders the confidence to make informed decisions.

- Well-Defined Risk Management: The precise nature of the Fibonacci ratios allows for tight stop-loss placement, minimizing potential losses.

- Profit Opportunities: When traded correctly, the bearish cypher can generate significant profits from market reversals.

Common Mistakes to Avoid

- Ignoring Fibonacci Ratios: The cypher pattern is highly dependent on accurate Fibonacci levels. Be precise in your measurements, and avoid entering trades if the ratios are not respected.

- Forcing the Pattern: Not every price move will form a cypher pattern. Ensure the pattern is fully developed before taking action.

- Lack of Confirmation: Combine the cypher pattern with other indicators or chart patterns for confirmation before entering a trade.

Conclusion

The bearish cypher harmonic pattern offers traders an advanced tool for spotting potential market reversals. By understanding the pattern’s structure and employing proper risk management, traders can capitalize on bearish market moves with greater confidence. Like all trading strategies, practice and patience are key. Use this pattern alongside other technical analysis tools for the best results in your trading journey.