Bear Call Spread Option Strategy

Hello Friends, Today, I am Going to Discuss about Bear Call Spread Option Strategy in Hindi. In the last post, we have learned about Bull call Spread Option Strategy. Today, we will discuss about Bear Call Spread. So, Lets Start, When we feel that Market is range bound or sideways and will expire within a range or in the falling market we can also use this strategy.

How To Use : In Bull Call Spread Strategy, we Buy the AT THE MONEY (ATM) Call Option of the any underlying Asset (Nifty, Bank Nifty, Fin Nifty or Any Stock) and sell the OUT OF MONEY OTM Call Option of the Same underlying Asset of the same Expiry. In this strategy, we do the opposite. We have to Buy OUT OF MONEY (OTM) Call Option and sell the AT THE MONEY (ATM) Call Option of the Same underlying Asset of the Same Expiry. In this way we receive the more premium of ATM strike and Pay the less Premium of OTM Strike.

Bear Call Spread Option Strategy Example

Mr. Khan is Bearish with the market (Nifty). Nifty is trading at 24858 on 23rd August 2024 and he believes that the Nifty will not go up in coming sessions for 29th August’s Expiry. So, he Sells the ATM Call option of 24850 Strike Price and receive the premium of 150 and Buy the OTM of 24950 Strike price at 80. We paid 80 points and Received 150points, so net receivable is 70 points.

Let’s break it down with Nifty trading at 24,850:

- Sell a Call Option:

- Strike Price: 24850

- Premium Received: ₹150 (example)

- Buy a Call Option:

- Strike Price: 24950

- Premium Paid: ₹80 (example)

Net Premium:

- The difference between the premiums is your net premium received:

- Net Premium Received: ₹150 – ₹80 = ₹70

Scenarios:

- If Nifty Stays Below 24850:

- Both options expire worthless.

- You keep the net premium of ₹70 as profit.

- If Nifty Rises Above 24850 but Stays Below 24950:

- The sold call (24850) will be exercised.

- The bought call (24950) will not be exercised.

- Your profit is capped at ₹70 minus any loss from the difference in strike prices.

- If Nifty Rises Above 24950:

- The bought call (24950) offsets the loss from the sold call (24850).

- Your maximum loss is the difference between the strike prices minus the net premium received.

- Max Loss: ₹100 – ₹70 = ₹30

| Nifty Spot Price: | 24858 |

| Lot size | 25 |

| Expiry | 29th August 2024 |

| Nifty 24850 Strike Price ATM | Premium Received : 150 points |

| Nifty 24950 Strike OTM | Premium Paid : 80 points |

| Net Premium Received | 70 Points |

| Break Even Point | 24920 |

| Maximum Loss | 30 Points |

| Maximum Reward | 70 Points |

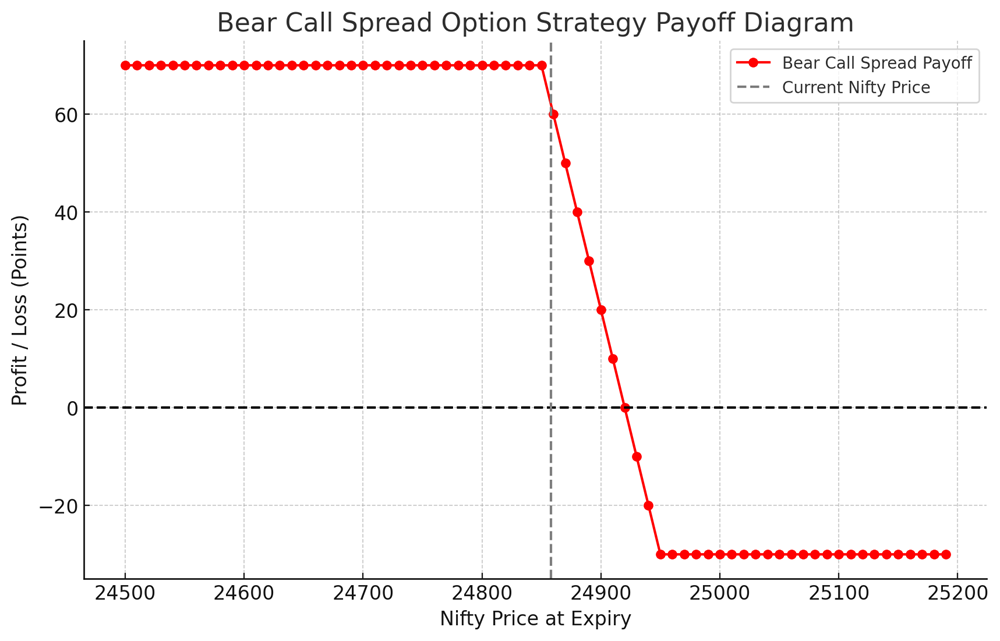

Here’s the payoff chart for the Bear Call Spread Option Strategy. It shows the profit and loss based on the Nifty’s price at expiry. The strategy benefits if the Nifty remains below the sold strike price (24850), with the maximum profit being 70 points (the net premium received). However, if the Nifty rises above the bought strike price (24950), losses can occur, capped by the bought option

PAY OFF TABLE

| On expiry Nifty Closes at | Net Payoff from Call Sold(Rs.) | Net Payoff from Call Buy (Rs.) | Net Payoff (Rs.) |

| 24500 | 150 | -80 | 70 |

| 24550 | 150 | -80 | 70 |

| 24600 | 150 | -80 | 70 |

| 24650 | 150 | -80 | 70 |

| 24700 | 150 | -80 | 70 |

| 24750 | 150 | -80 | 70 |

| 24800 | 150 | -80 | 70 |

| 24850 | 150 | -80 | 70 |

| 24900 | 100 | -80 | 20 |

| 24950 | 50 | -80 | -30 |

| 25000 | 0 | -30 | -30 |

| 25050 | -50 | 20 | -30 |

| 25100 | -100 | 70 | -30 |

| 25150 | -150 | 120 | -30 |

| 25200 | -200 | 170 | -30 |

| 25250 | -250 | 220 | -30 |

| 25300 | -300 | 270 | -30 |

| 25350 | -350 | 320 | -30 |

| 25400 | -400 | 370 | -30 |

| 25450 | -450 | 420 | -30 |

Bear Call Spread Strategy in Hindi

Bear Call Spread Option Strategy in Hindi:

Hello दोस्तों,

आज हम बात करेंगे Bear Call Spread Option Strategy के बारे में हिन्दी में। पिछली पोस्ट में हमने Bull Call Spread Option Strategy के बारे में सीखा था। आज हम Bear Call Spread पर चर्चा करेंगे। तो चलिए शुरू करते हैं।

Bear Call Spread कब इस्तेमाल करें:

जब हमें लगे कि बाजार रेंज-बाउंड या साइडवे है और एक निश्चित रेंज के अंदर ही समाप्त होगा, या गिरते बाजार में भी इस रणनीति का उपयोग कर सकते हैं।

कैसे इस्तेमाल करें:

Bull Call Spread Strategy में, हम किसी भी अंडरलाइनिंग एसेट (जैसे Nifty, Bank Nifty, Fin Nifty या किसी स्टॉक) का एट द मनी (ATM) कॉल ऑप्शन खरीदते हैं और आउट ऑफ मनी (OTM) कॉल ऑप्शन बेचते हैं। लेकिन Bear Call Spread Strategy में इसका उल्टा करते हैं। हम आउट ऑफ मनी (OTM) कॉल ऑप्शन खरीदते हैं और एट द मनी (ATM) कॉल ऑप्शन बेचते हैं। इस तरह, हमें ATM स्ट्राइक का अधिक प्रीमियम मिलता है और OTM स्ट्राइक का कम प्रीमियम देना पड़ता है।

Bear Call Spread Option Strategy का उदाहरण:

Mr. Khan का मानना है कि मार्केट (Nifty) गिरावट में रहेगा। 23 अगस्त 2024 को Nifty 24858 पर ट्रेड कर रहा है और उन्हें लगता है कि Nifty आने वाले सेशन में नहीं बढ़ेगा। इसलिए, वे 24850 स्ट्राइक प्राइस का ATM कॉल ऑप्शन बेचते हैं और 150 पॉइंट का प्रीमियम प्राप्त करते हैं, और 24950 स्ट्राइक प्राइस का OTM कॉल ऑप्शन खरीदते हैं और 80 पॉइंट का भुगतान करते हैं। उन्होंने 80 पॉइंट दिए और 150 पॉइंट प्राप्त किए, तो शुद्ध रूप से 70 पॉइंट का मुनाफा हुआ।

| On expiry Nifty Closes at | Net Payoff from Call Sold(Rs.) | Net Payoff from Call Buy (Rs.) | Net Payoff (Rs.) |

| 24500 | 150 | -80 | 70 |

| 24550 | 150 | -80 | 70 |

| 24600 | 150 | -80 | 70 |

| 24650 | 150 | -80 | 70 |

| 24700 | 150 | -80 | 70 |

| 24750 | 150 | -80 | 70 |

| 24800 | 150 | -80 | 70 |

| 24850 | 150 | -80 | 70 |

| 24900 | 100 | -80 | 20 |

| 24950 | 50 | -80 | -30 |

| 25000 | 0 | -30 | -30 |

| 25050 | -50 | 20 | -30 |

| 25100 | -100 | 70 | -30 |

| 25150 | -150 | 120 | -30 |

| 25200 | -200 | 170 | -30 |

| 25250 | -250 | 220 | -30 |

| 25300 | -300 | 270 | -30 |

| 25350 | -350 | 320 | -30 |

| 25400 | -400 | 370 | -30 |

| 25450 | -450 | 420 | -30 |

Disclaimer : This article is written for Education Purpose Only. We don’t recommend anyone to Buy or sell. Before making any trade always consult your financial advisor. we are not responsible for any loss.

If you are looking for Option Trading Course Call us Now 8287996284 Follow us On Instagram

One Reply to “Bear Call Spread Option Strategy in Hindi”

Comments are closed.