Head and Shoulders Pattern

What is Head and Shoulders pattern, how it forms and how to trade it. Today we will learn about The Head and Shoulders pattern is a popular chart pattern in technical analysis, signaling a potential reversal in the trend. Welcome to the another post of Technical Analysis series of Chart patterns. Here’s a detailed breakdown about Head and Shoulders pattern:

Meaning of the Head and Shoulders Pattern

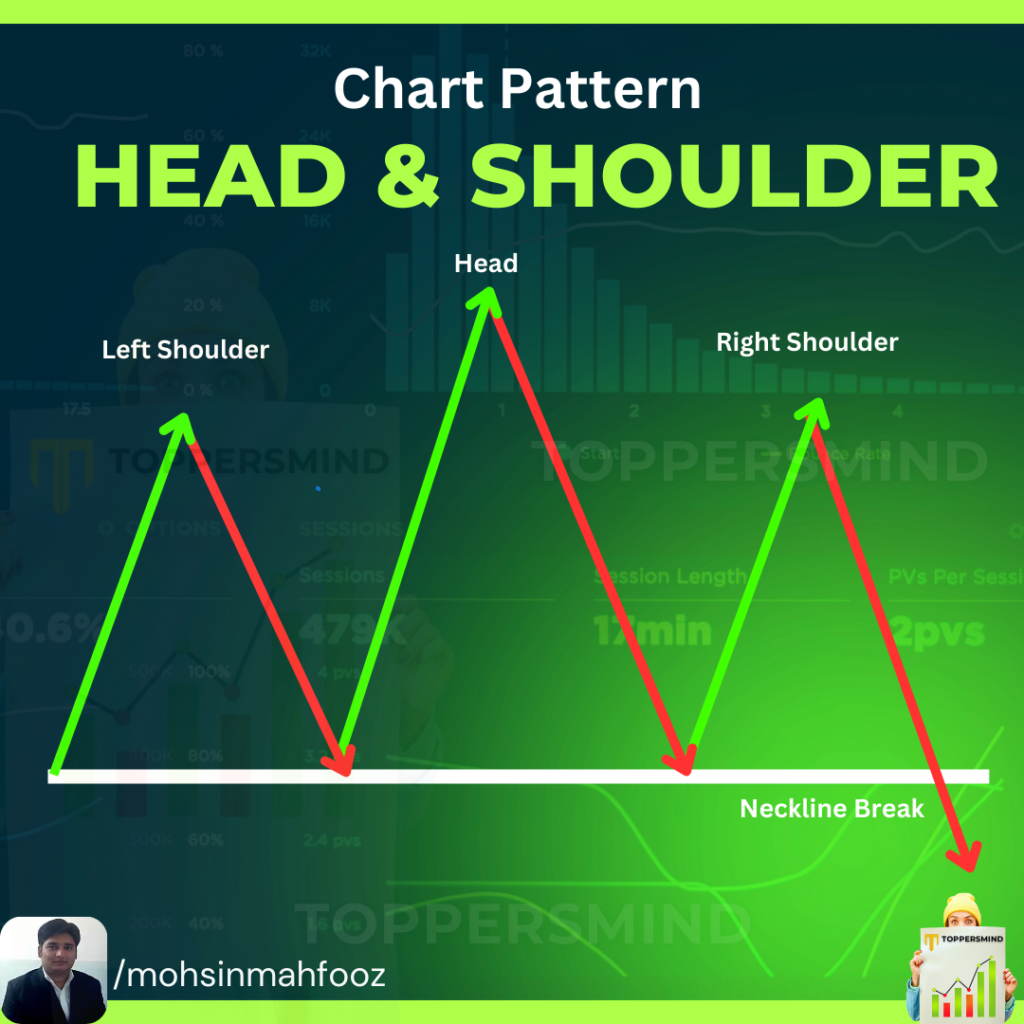

The Head and Shoulders pattern is a bearish reversal pattern that forms at the peak of an uptrend. It consists of three peaks:

- Left Shoulder: A peak followed by a pullback.

- Head: A higher peak than the left shoulder, followed by another pullback.

- Right Shoulder: A lower peak than the head but similar to the left shoulder, followed by a decline.

The neckline connects the lows formed between the shoulders and the head.

It indicates that the upward momentum is weakening and a bearish trend may emerge.

Formation of the Head and Shoulders Pattern

- Uptrend: The pattern forms after a sustained uptrend.

- Left Shoulder: Price rises, then declines to form the first low.

- Head: Price rallies again to a higher peak, then declines.

- Right Shoulder: A smaller rally creates a peak similar to the left shoulder, followed by another decline.

- Neckline: A support level is formed by connecting the two pullbacks.

- Breakout: When the price breaks below the neckline, it confirms the pattern.

How to Trade the Head and Shoulders Pattern

- Identify the Pattern: Ensure the formation is clear with all three peaks and a neckline.

- Wait for the Breakout: Trade is triggered only after the price breaks below the neckline.

- Entry Point: Enter a sell/short position when the price closes below the neckline.

- Stop Loss: Place a stop loss above the right shoulder to limit losses.

- Target Price: Measure the distance between the head and neckline and project it downward from the breakout point for the target price.

Advantages of the Head and Shoulders Pattern

- Reliable Reversal Signal: It often predicts a trend reversal accurately.

- Clear Entry and Exit Points: The neckline provides a defined level for entry and target projection.

- Widely Recognized: Used by traders globally, increasing its reliability.

Disadvantages of the Head and Shoulders Pattern

- False Breakouts: Sometimes the price may break the neckline but fail to follow through.

- Time-Consuming: The pattern takes time to form, which may delay decision-making.

- Subjectivity: Identifying the pattern can be subjective, especially in choppy markets.

- Not Foolproof: It should be used in conjunction with other indicators for confirmation.

Follow us on instagram @mohsinmahfooz