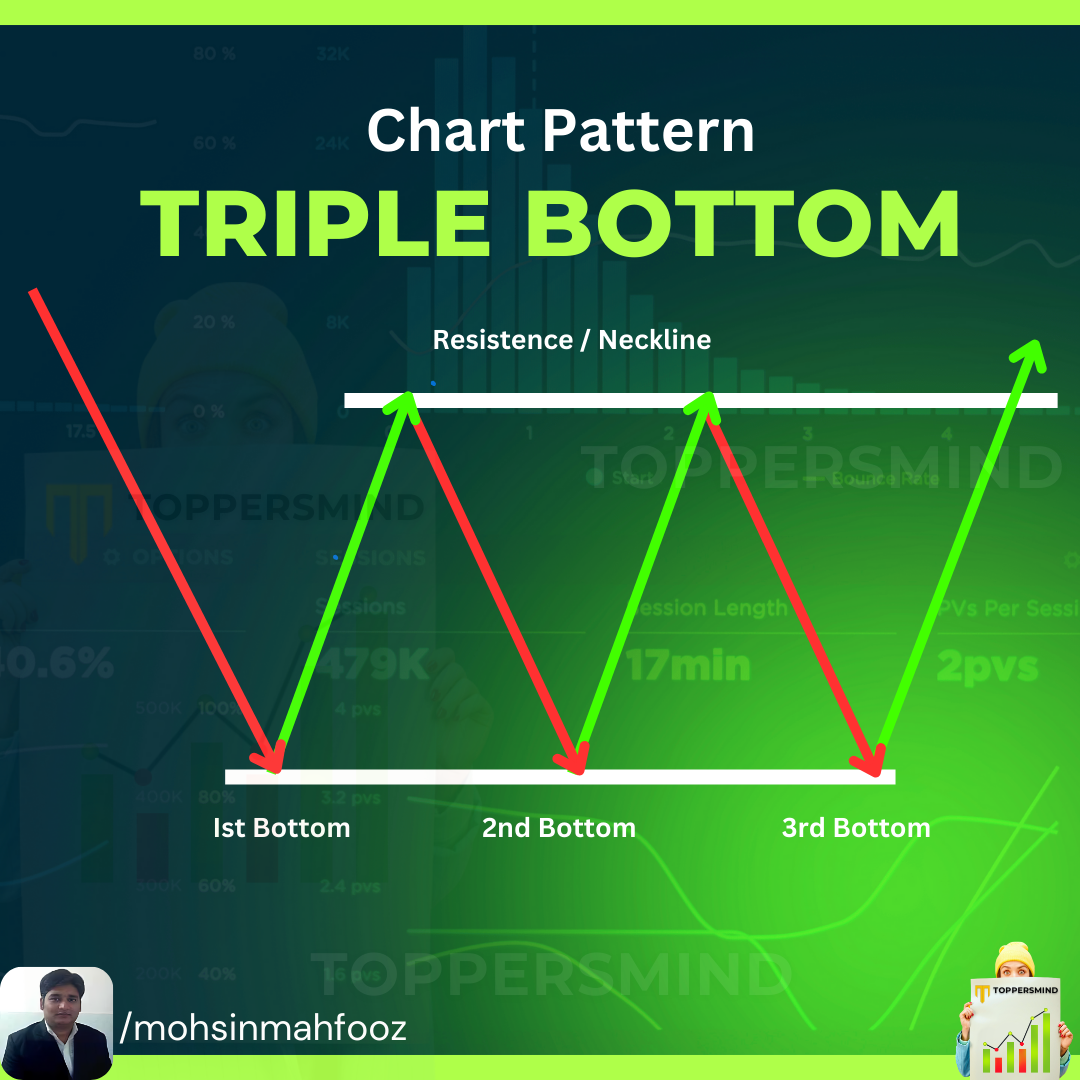

Triple Bottom Pattern

Triple Bottom Chart Pattern : Today we will learn about the Triple Bottom Pattern. The Triple Bottom is a bullish reversal chart pattern that typically forms after a downtrend. It consists of three distinct lows occurring at roughly the same price level, indicating strong support. This pattern signifies that the selling pressure is weakening, and buyers are gaining control, likely leading to a trend reversal to the upside.

Formation of the Triple Bottom Pattern

- Downtrend: The pattern begins after a sustained downtrend.

- Three Lows: The price touches a support level three times, failing to break below it. These lows should be approximately at the same price level.

- Resistance Breakout: After forming the third bottom, the price rallies and breaks above the resistance level (formed by the peaks between the lows). This breakout confirms the pattern.

- Volume Increase: The breakout is often accompanied by a spike in trading volume, further validating the reversal.

How to Trade the Triple Bottom Pattern

- Entry Point: Enter a long position when the price breaks above the resistance level.

- Stop Loss: Place a stop loss below the lowest of the three bottoms to manage risk.

- Target Price: Measure the distance between the support and resistance levels and project it upward from the breakout point.

Example:

- Support Level: ₹100

- Resistance Level: ₹120

- Target: ₹120 + (₹120 – ₹100) = ₹140

Advantages of the Triple Bottom Pattern

- Reliable Reversal Signal: It provides a strong indication of a bullish trend reversal.

- Defined Risk-Reward Ratio: The pattern’s structure allows traders to set clear stop-loss and target levels.

- Easy to Identify: Its visual structure is easy to spot, even for beginners.

Disadvantages of the Triple Bottom Pattern

- Time-Consuming: The pattern takes a long time to form, delaying trading decisions.

- False Breakouts: There’s a risk of false breakouts where the price reverses back below resistance.

- Subjectivity: Identifying perfect triple bottoms can sometimes be challenging, especially in volatile markets.