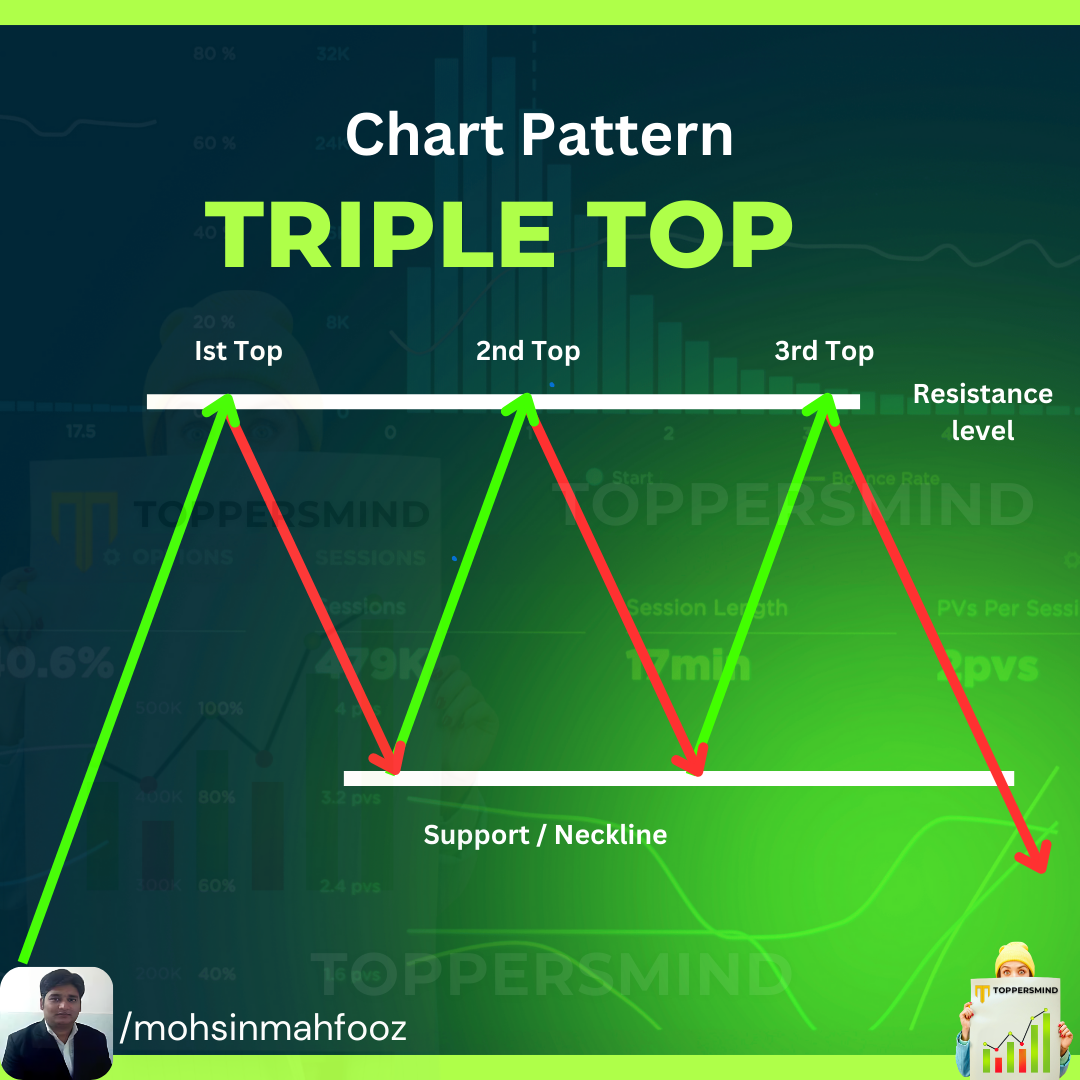

Triple Top Chart Pattern

The Triple Top pattern is a classic chart pattern in technical analysis, often used to identify potential reversals in an uptrend. It signals that the price is struggling to break through a resistance level and may reverse to a downtrend. Below is a detailed explanation of its meaning, formation, and how to trade it.

Meaning of Triple Top Pattern

- A Triple Top pattern is a bearish reversal pattern that forms after an extended uptrend.

- It indicates that the price has made three failed attempts to break above a strong resistance level, showing weakening buying pressure.

- The pattern reflects market psychology, where buyers are unable to push the price higher, and sellers gradually gain control.

Formation of Triple Top Pattern

- Uptrend Preceding the Pattern:

- The price must be in an uptrend before the pattern forms. This gives the pattern its reversal characteristic.

- Three Peaks:

- The price hits a resistance level three times, creating three distinct peaks.

- These peaks are roughly at the same level, showing that the resistance is strong.

- Declining Volume:

- The volume typically decreases as the pattern develops, reflecting a lack of enthusiasm from buyers.

- Support Level (Neckline):

- A horizontal or slightly sloping support level forms below the peaks, connecting the low points between them.

- Breakdown Below Support:

- The pattern is confirmed when the price breaks below the support level (neckline) with increased volume.

How to Trade the Triple Top Pattern

- Identify the Pattern:

- Look for three peaks at a similar level after an uptrend.

- Confirm the support (neckline) and ensure the peaks are evenly spaced.

- Wait for Confirmation:

- Do not act immediately after spotting the pattern. Wait for the price to break below the neckline with strong volume to confirm the bearish reversal.

- Entry Point:

- Enter a short position (sell) when the price breaks below the neckline.

- Alternatively, wait for a retest of the neckline after the breakdown for a more conservative entry.

- Stop-Loss Placement:

- Place a stop-loss just above the resistance level (peaks) to protect against false breakouts.

- Target Price:

- Measure the height of the pattern (distance between the neckline and the peaks).

- Project this distance downward from the neckline to set your target price.

- Monitor Volume:

- Ensure that the breakdown occurs with high volume, as it confirms the strength of the bearish move.

Key Notes:

- False Breakouts: Sometimes, the price may briefly break below the neckline and then reverse upward. Use stop-loss orders to minimize risk.

- Timeframe: The pattern can form on different timeframes, from intraday charts to weekly charts. Adjust your trading strategy based on the timeframe.

- Combination with Indicators: Combine the Triple Top pattern with indicators like the Relative Strength Index (RSI) or MACD to confirm the bearish momentum.

Conclusion

The Triple Top pattern is a reliable bearish reversal signal when identified and traded correctly. By patiently waiting for confirmation and managing risk effectively, traders can use this pattern to capitalize on trend reversals. Remember to combine it with other tools for better accuracy and ensure proper risk management in every trade.

You May Also Want to know about Double Top Chart Pattern