Bear Put Spread Strategy in Hindi

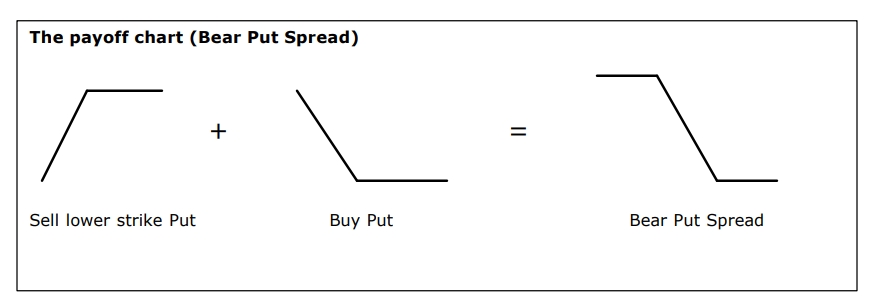

(BUY PUT, SELL PUT)

Bear Put Spread Strategy in Hindi : In the Previous Post, we have learn about Bull Put Spread Option Strategy. Today, we are going to learn about Bear Put Spread Strategy with live Example of Nifty. Nifty is trading at 25230 Today. And we are going to make Bear Put Spread Between 25300 PUT and 25200 Put of 5th September 2024 Expiry. The Bear Put Spread is a bearish options trading strategy that involves buying a higher strike put option and selling a lower strike put option, both with the same expiry date. This strategy is used when a trader expects a moderate decline in the price of the underlying asset.

Bear Put Spread Option Strategy Example

Lets understand Bear Put Spread Strategy with the help of this Example: Nifty is Trading around 25230 on 30th August 2024 and we are choosing the Expiry of 5th September 2024. Mr. Khan is Moderately Bearish with the Market and Believes that Nifty will not go below the 25200 Level on this Expiry. So, He Enters in a trade by making a position of Buying a ATM put option of 25300 strike Price and Pays the Premium of 150 Points and at the same time selling an OTM Put Option of 25200 strike price of the Same Expiry and receives the premium of 100 points.

In This Trade, he is Paying the Premium of 150 points and Receving the premium of only 100 points. Net Paying is 50 Points. And that is the Maximum loss for this Trade. While 50 Points is the Maximum Profit he can have at expiry.

Nifty Trading Scenario:

- Nifty Price: 25,230

- Expiration Date: 5th September

Components of the Strategy:

- Buy a Higher Strike Put Option: For example, buy a 25,300 strike put option at 150

- Sell a Lower Strike Put Option: For example, sell a 25,200 strike put option at 100

How It Works:

- Buying the Higher Strike Put: This gives you the right to sell Nifty at 25,300, benefiting if the Nifty price falls below this level.

- Selling the Lower Strike Put: This obligates you to buy Nifty at 25,200, capping your profit but reducing the cost of the strategy.

| Nifty Spot Price: | 25230 |

| Lot size | 25 |

| Expiry | 5th September 2024 |

| Nifty 25300 Strike Price ATM | Premium Paid : 150 points |

| Nifty 25200 Strike OTM | Premium Received : 100 points |

| Break Even Point | 50 Points |

| Net Premium Paid | 50 Points |

| Maximum Loss | 50 Points |

| Maximum Reward | 50Points |

PAY OFF TABLE

| On expiry Nifty Closes at | Net Payoff from PUT Sold(Rs.) | Net Payoff from PUT Buy (Rs.) | Net Payoff (Rs.) |

| 25000 | -100 | 150 | 50 |

| 25050 | -50 | 100 | 50 |

| 25100 | 0 | 50 | 50 |

| 25150 | 50 | 0 | 50 |

| 25200 | 100 | -50 | 50 |

| 25250 | 100 | -100 | 0 |

| 25300 | 100 | -150 | -50 |

| 25350 | 100 | -150 | -50 |

| 25400 | 100 | -150 | -50 |

| 25450 | 100 | -150 | -50 |

| 25500 | 100 | -150 | -50 |